The variability of the economic environment, the restructuring of value systems, and the shrinking future value of existing large benefit systems (state pension system, healthcare) call on all active earning citizens to address their future pension situation!

CORIS Hungary has entered into a strategic partnership with UNION Insurance so that you can plan your pension safely.

Have you ever heard that…

· Has the number of retirees increased by more than half a million in the last 20 years? while in 1990 2 million 520 thousand people received pension-like benefits, by the beginning of 2009 the number of beneficiaries 3 million rose to 31 thousand

· Are there more citizens over the age of 60 than young people under the age of 20? 2.2 million people over the age of 60 and 2.1 million people under the age of 20

· By 2030, will society continue to age? those over 60 will be more than one and a half times as many as those under 20

· Will the population decrease by half a million by 2030? despite an increase in life expectancy.

· Will your expected pension be less than your previous income?

· After an unexpected accident, will your invalidity pension be even lower than your old-age pension?

· 3.7 million pensioners currently produce pensions for 3.7 million contributors, and this proportion is deteriorating year by year?

· Approx. Are more than a third of 3.7 million contributors declared for a minimum wage?

· Does it take at least 20 years of service to reach the retirement age in order to be entitled to an old-age pension?

· Is the pension based on the income on which you paid contributions?

· The amount of the minimum pension is currently barely HUF 30,000?

· If you pay contributions for the minimum wage, can you expect a pension of just over HUF 30,000?

A lot of people’s existence can be ruined because they don’t realize that: they have to accumulate capital through self-sufficiency.

You will find the ideal solution to these problems with us!

Let’s collect your pension together!

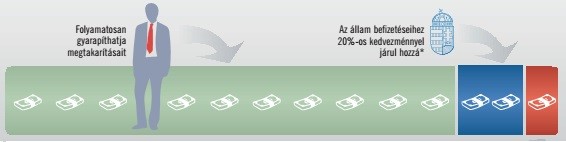

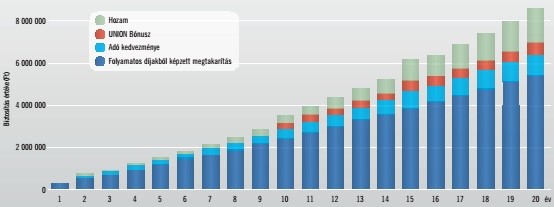

The state contributes to its continuous savings with a 20% discount *, while UNION can increase it by up to 10%!

If you take care of your savings on a regular basis, we will credit 100% of your lowest annual fee to your contract in year 10 and then credit you with another 50-50% in years 15 and 20.

The example was calculated taking into account the following data: HUF 300,000 annual fee, value reduced by costs and increased by an assumed return of 5%

Preparing for unexpected events

The UNION-Pension Program II. offers you a safety net, as it provides financial assistance to you or your loved ones even in the event of permanent damage to health ** or death during the savings period.

Adding to your savings

You can sometimes supplement your continuously paid amounts for self-sufficiency with extra savings to supplement your pension, in which case you will also receive a 20% tax deduction for these amounts.

Extensive investment opportunities

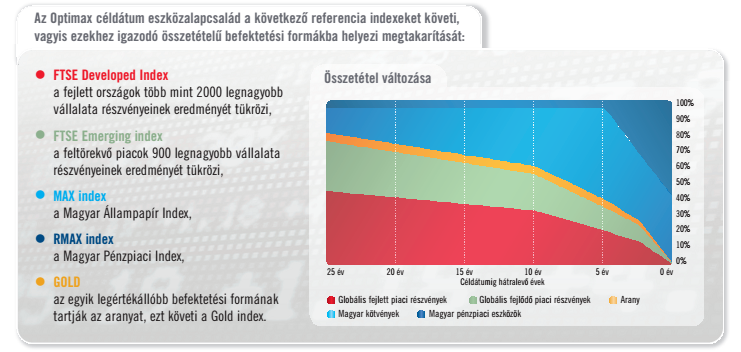

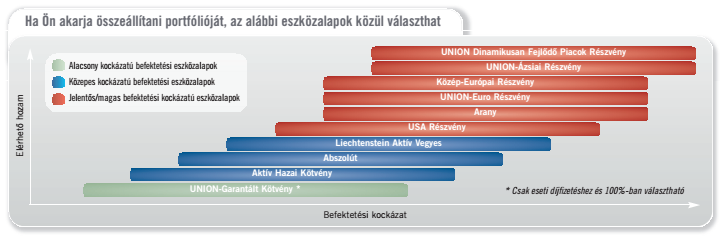

If you would trust experts to manage your portfolio, choose a target date asset fund optimized for your retirement. The Optimax target date asset fund family includes assets with a constantly changing composition, which initially invest in higher risk and yield-expected funds, later becoming more conservative in order to avoid losses due to fluctuations in riskier investments as the target date approaches.

If you want to build your portfolio, you can easily select from our wide range of asset funds the ones that best suit your return expectations and risk appetite.

Free exchange rate monitoring service

With the help of the Exchange Rate Monitor service, you can protect your savings from major exchange rate falls even in unfavorable stock market conditions! As part of the service, you determine the maximum exchange rate drop you are willing to tolerate, so you can limit your losses when exchange rates fall. ***

The UNION-Pension Program II. additional benefits

The amount of the service can be inherited either as an amount or as an annuity.

The maturity service is exempt from interest tax and EHO

- Free Teledoctor service: medical call center

The information is not complete!

Please read the terms and conditions of the insurance and the applicable tax provisions carefully.

For more information, call +36 1 372 3090, your CORIS consultant is at your disposal!

I'm interested!

Érdekel!

Downloadable documents :

UNION-Nyugdíj Program II. Ügyféltájékoztató

UNION-Nyugdíj Program II. Visszavásárlási értékek

UNION-Nyugdíj Program II. TKM tájékoztató

UNION-Nyugdíj Program II. Járadékszolgáltatás feltételei

UNION-Nyugdíj Program II. Befektetési politika

UNION-Nyugdíj Program II. Kondíciós lista

UNION-Nyugdíj Program II. Különös Biztosítási Feltételek

* Exercising the right of disposal up to a maximum of HUF 130,000 per year, together with a pension savings account and voluntary fund savings, up to a total of HUF 280,000

** Above at least 40% of health damage as determined by social security.

***Please note that when using the Exchange Rate Monitor service, it is advisable to periodically review your portfolio after the automatic conversion of the value of the investment fund in case the exchange rate falls below the exchange rate monitoring value to ensure that your savings are in line with your original return expectations.

Insurance

Be it unemployment, even protection against loss of income, even life insurance, we are committed toto be unique, customized, at the same time provide quality serviceand all this at reasonable fees a “Partner in everyday life” under the banner of our slogan.

Claims Settlement

More than 250 insurance companies, Europe-wide representation guarantees youthat your claim and the full claims settlement process are in the best hands with us, a “Partner in everyday life” under the banner of our slogan